Madison Life Targets Informal Sector to Raise Insurance Uptake

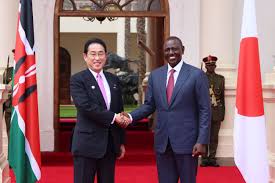

Madison Life Assurance company managing director Githua Ngaruiya addressing media at Mama Ngina water front. (PhotoBy Mbungu Harrison)

By Mbungu Harrison

Email, thecoastnewspaper@gmail.com

Madison Life Assurance Limited has intensified efforts to create awareness of insurance targeting the informal sector; a segment the insurer says holds the key to boosting the industry’s contribution to the economy.

Kenya’s insurance spread, currently stands at 2.3 per cent of GDP, a figure the Madison Life managing director Githua Ngaruiya says is far below potential.

Speaking in Mombasa during the launch of a nationwide advocacy campaign, Mr Ngaruiya underscored the importance of cultivating a strong saving culture, particularly among residents in the coastal region.

“Saving remains a crucial safeguard against future risks. A small saving goes a long way,” he said noting that despite Mombasa being one of the fastest-growing regions in the country, it still lags in savings and insurance uptake.

To address this, the insurer is introducing a daily premium of Ksh500 aimed at making insurance more accessible to informal sector earners who typically operate on day-to-day cash flows.

Madison believes this approach could significantly raise national insurance penetration to above seven per cent, in line with industry targets.

The MD also encouraged unemployed youth to take advantage of income opportunities as Madison sales agents, saying the company is widening its distribution network as part of the campaign.

The firm is complementing government measures to strengthen the sector, including the newly enacted Insurance Professionals Act 2025, which the MD said has streamlined regulatory processes and expanded market reach for insurers.

National sales manager Joseph Gathogo highlighted that the introduction of daily premiums represents a major shift in Madison’s business model, enabling the company to cater to Kenyans across all income brackets.

Coast region sales manager Monica Mitei urged young people to visit Madison branches in Mombasa, Malindi, Diani and Voi to explore opportunities within the firm.

She added that the company’s caravan will conduct extensive customer engagement across major coastal markets from Mwembe Tayari and Mackinnon Road to Kongowea, Bombolulu, Bamburi, Mtwapa and finally Kilifi town.

“We invite everyone to visit our activation tents, learn about our education, retirement and investment solutions, and engage with our financial advisors,” she said.

Madison’s head of marketing Dr Yvonne Tharau, announced that the company is also developing Shariah-compliant insurance products to better serve the Muslim community.

She emphasised that insurance is increasingly being recognised as a basic necessity for financial stability.

The insurer expects that technology-enabled access to policies, daily-premium offerings and targeted outreach in underserved areas will play a key role in expanding insurance coverage across the country.